Social Security Taxable Limit 2024

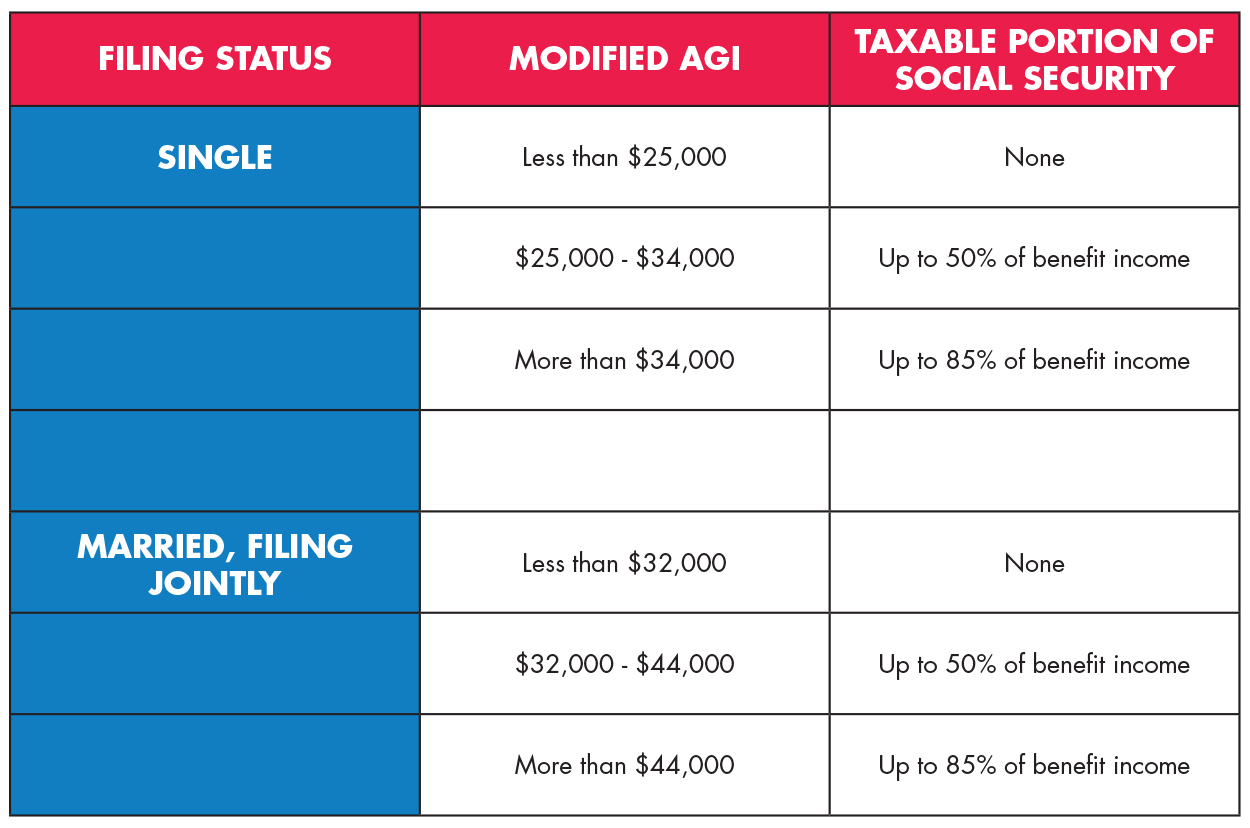

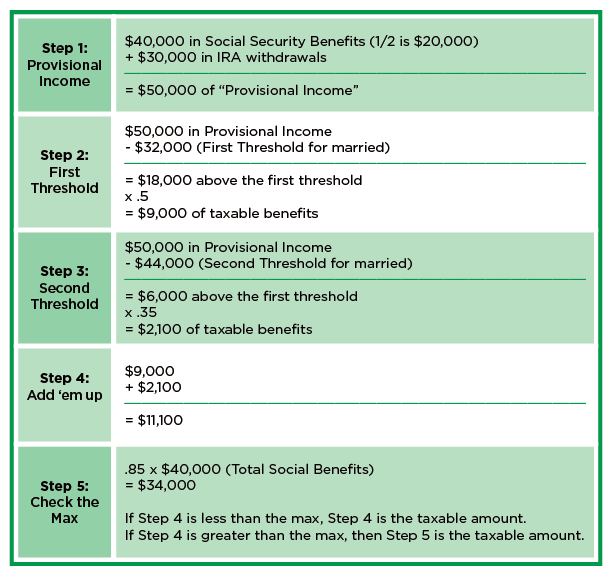

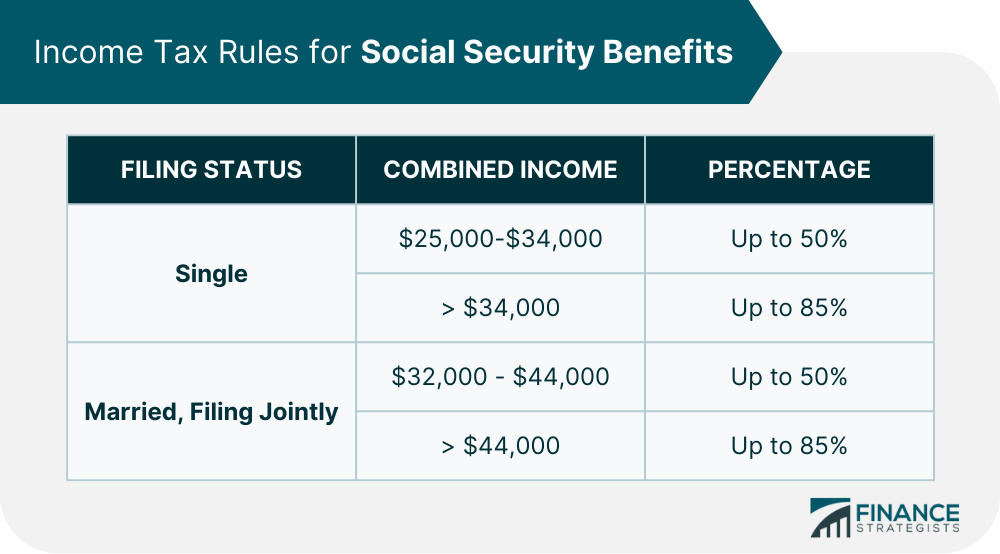

Social Security Taxable Limit 2024. Up to 85% of your social security benefits are taxable if: The social security limit is $168,600 for 2024, meaning any income you make over $168,600 will not be subject to social security tax.

Married filers with an agi of less than $60,000 may qualify for a full exemption ($45,000. In 2024, the social security tax limit rises to $168,600.

This Amount Is Also Commonly Referred To As The Taxable Maximum.

The limit for 2023 and 2024 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

We Call This Annual Limit The Contribution And Benefit Base.

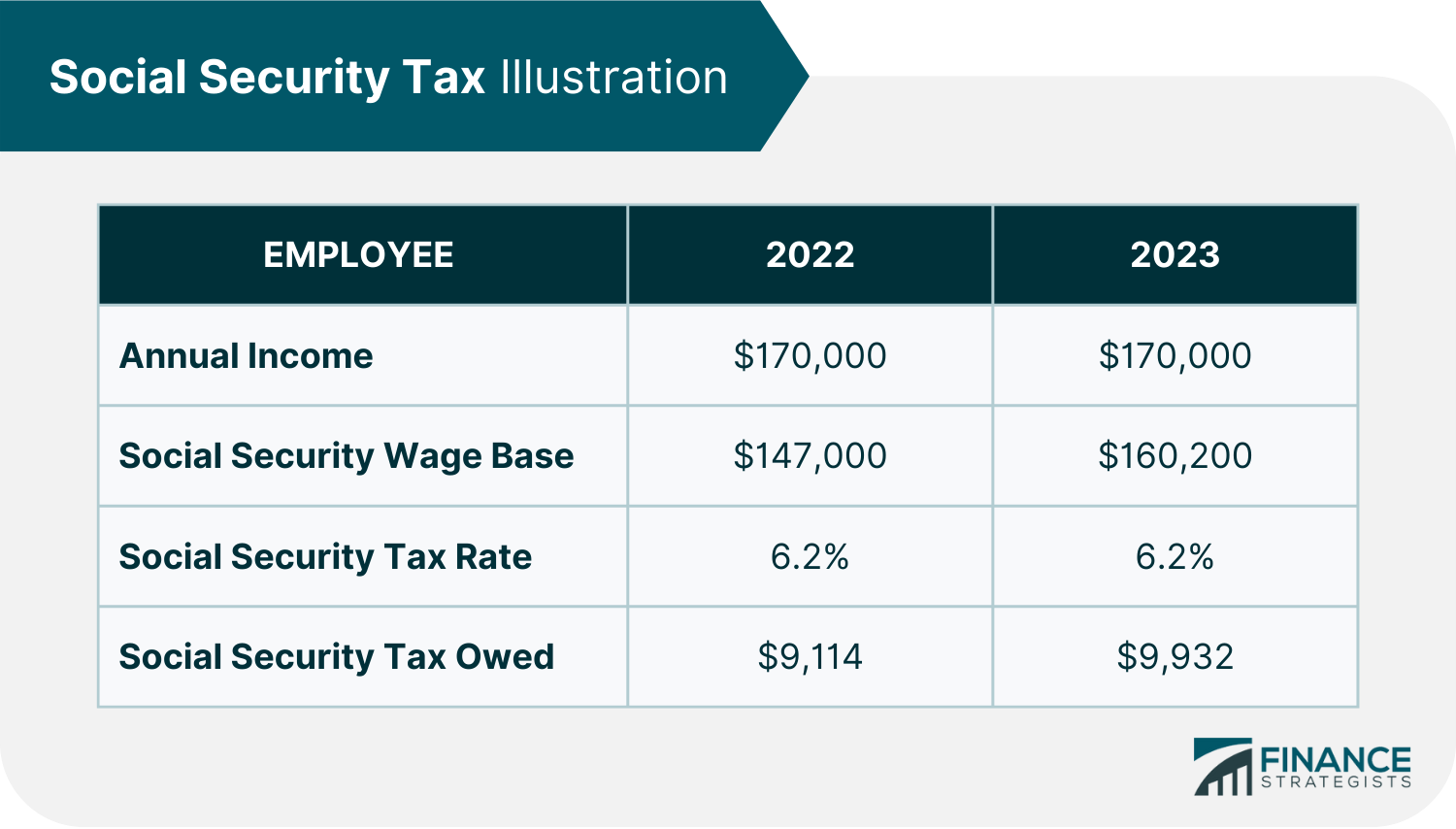

(for 2023, the tax limit was $160,200.

Social Security Taxable Limit 2024 Images References :

Source: robbyloralie.pages.dev

Source: robbyloralie.pages.dev

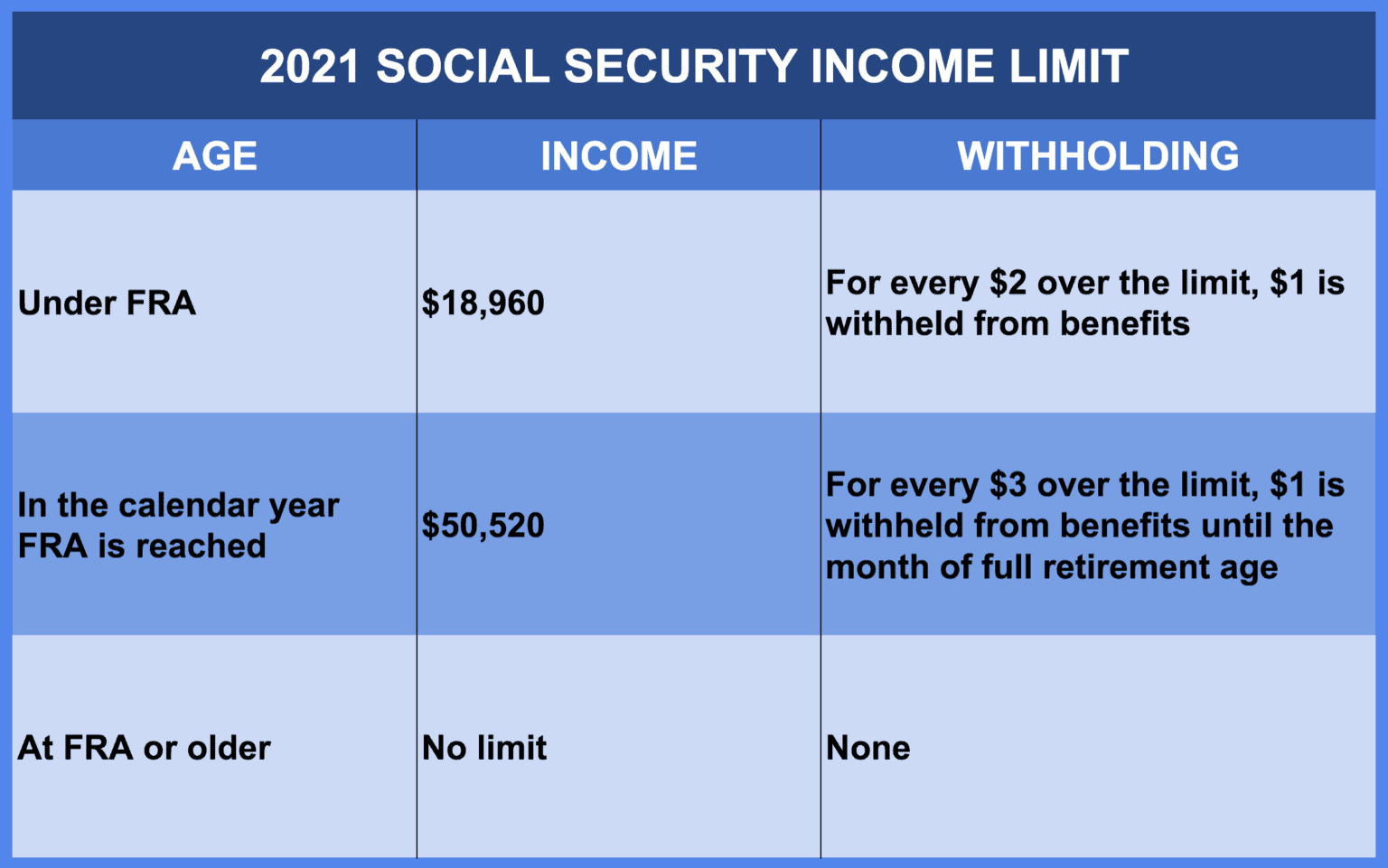

Social Security Taxable Limit 2024 Irs Sadye Conchita, Five things to know about social security and taxes; We use the following earnings limits to reduce your benefits:

Source: loriqsashenka.pages.dev

Source: loriqsashenka.pages.dev

Social Security Tax Limit 2024 Withholding Chart Meggy Silvana, The limit for 2023 and 2024 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. For 2024, the social security tax limit is $168,600 (up from $160,200 in 2023).

Source: jackylilian.pages.dev

Source: jackylilian.pages.dev

2024 Maximum Social Security Tax Ailey Anastasie, Up to 85% of your social security benefits are taxable if: The social security limit is $168,600 for 2024, meaning any income you make over $168,600 will not be subject to social security tax.

Source: adiverene.pages.dev

Source: adiverene.pages.dev

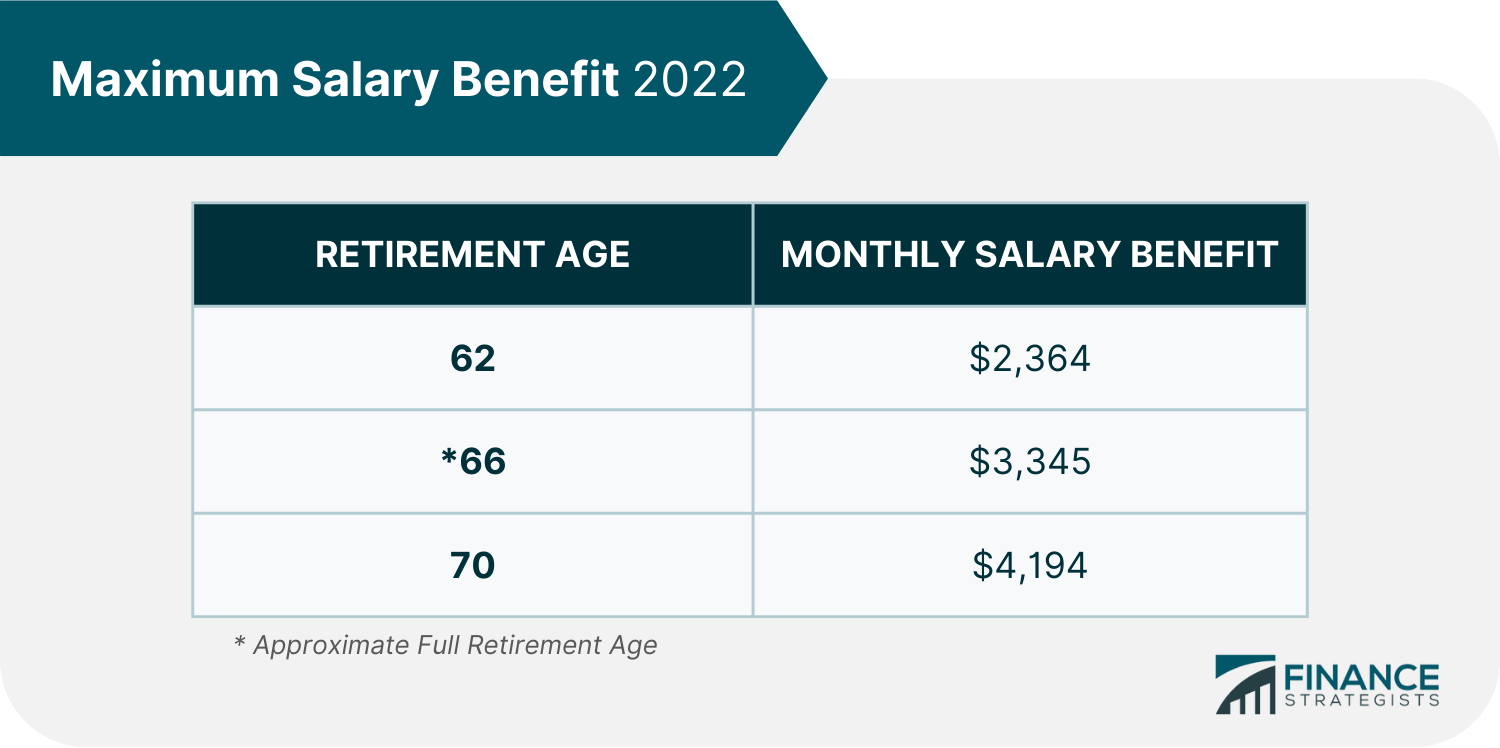

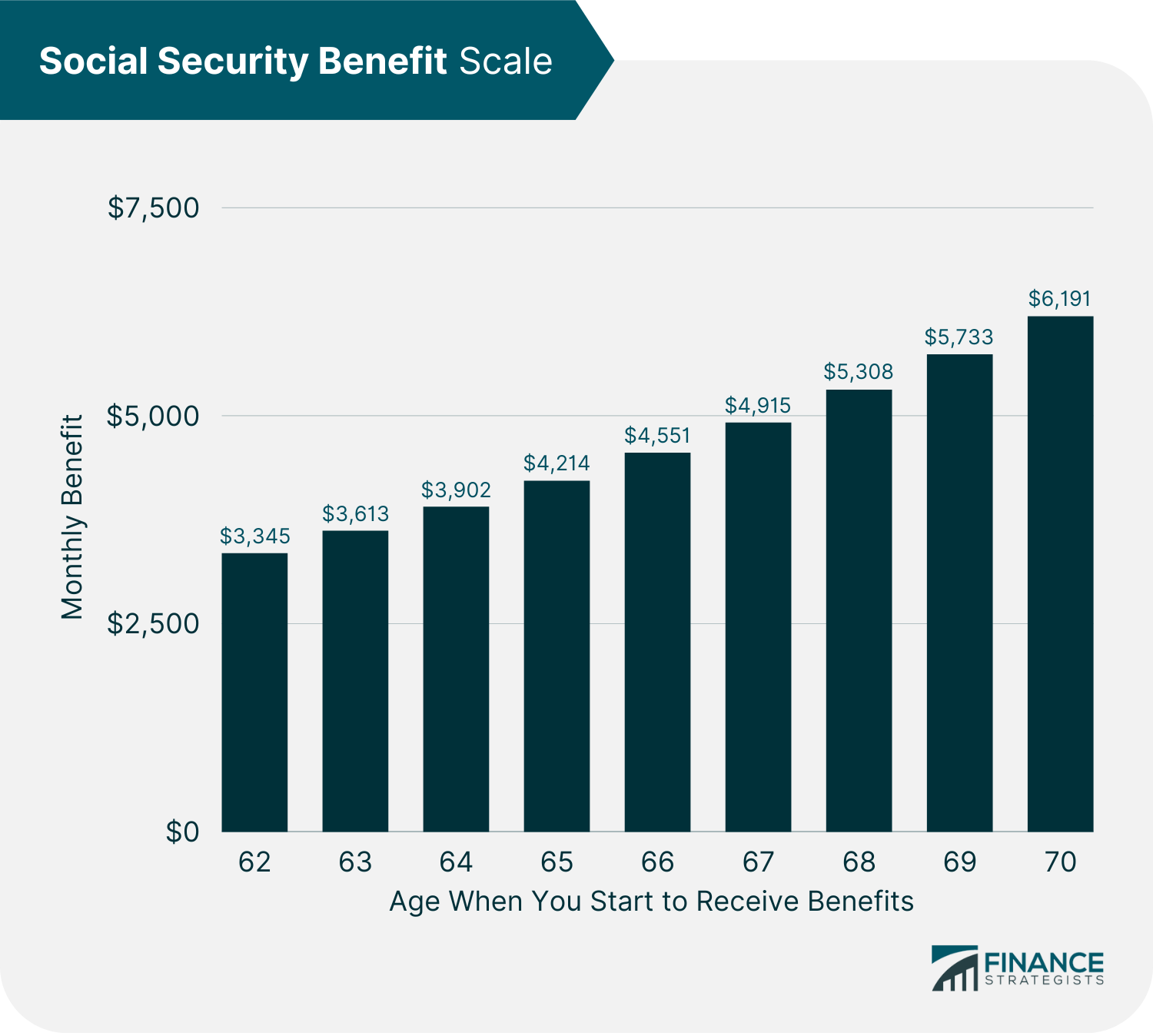

Social Security Tax Limit 2024 Withholding Chart, The wage base or earnings limit for the 6.2% social security tax rises every year. The maximum social security benefit in 2024 is $4,873 per month or $58,476 for the year.

Source: tresabmildred.pages.dev

Source: tresabmildred.pages.dev

Social Security Taxable Limit 2024 Carey Correna, But beyond that point, you'll have $1 in benefits withheld per $2 of. However, if you’re married and file separately, you’ll likely have.

Source: reynaqaurelea.pages.dev

Source: reynaqaurelea.pages.dev

Maximum Social Security Tax 2024 Withholding Tax Elane Xylina, Most people do not get that much, though. (for 2023, the tax limit was $160,200.

Source: salliewtalya.pages.dev

Source: salliewtalya.pages.dev

What'S The Max Social Security Tax For 2024 Carin Cosetta, You file a federal tax return as an individual and your combined income is more than $34,000. The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600.

Source: luiseqvalera.pages.dev

Source: luiseqvalera.pages.dev

Social Security Benefits Tax Bracket 2024 Daffy Coralyn, However, if you’re married and file separately, you’ll likely have. The 2024 tax limit is $8,400 more than the 2023 taxable maximum of $160,200 and $61,800 higher than the 2010 limit of $106,800.

Source: emlynnqharriott.pages.dev

Source: emlynnqharriott.pages.dev

Irs Social Security Tax Limit 2024 Kiley Merlina, Five things to know about social security and taxes; In 2024, the social security tax limit rises to $168,600.

Source: ericaqbeitris.pages.dev

Source: ericaqbeitris.pages.dev

Ssi Household Limits 2024 Sonja Eleonore, Married filers with an agi of less than $60,000 may qualify for a full exemption ($45,000. (for 2023, the tax limit was $160,200.

Five Things To Know About Social Security And Taxes;

Your social security benefits are taxable based on your filing status and agi.

However, If You’re Married And File Separately, You’ll Likely Have.

Married filers with an agi of less than $60,000 may qualify for a full exemption ($45,000.

Posted in 2024